Sime Darby during the demerger was seen almost as an afterthought - a by-product of two other more attractive siblings in the plantation and property sectors. But now, it is Sime Darby’s stock that has held up better than its siblings and its regional exposure is seen as a difference from the many domestic-oriented big-cap stocks on Bursa Malaysia.

Republished from Starbiz, Saturday, 19 October 2019

Hanging on the walls of the corporate floor of the new Sime Darby Bhd building are artworks by Datuk Ibrahim Hussein. The various pieces of Ibrahim’s art were bought when he was a young artist for a fraction of the millions the entire collection is valued at today.

Helping local art and culture seems to be the mission of many government-linked companies and agencies that now have expensive art of local artists adorning the walls of their offices. The collection at Sime Darby’s office did catch the eye of Tan Sri Zeti Akhtar Aziz, chairman of Permodalan Nasional Bhd (PNB) which is the controlling shareholder of Sime Darby, who has passed a remark that the art at Sime Darby costs more than what graces the similar corporate office of PNB.

Maybe it’s an eye for talent, or maybe it was pure luck but the worth of Sime Darby’s art collection mirrors just what many had thought of the company prior to the demerger of the group that split Sime Darby into itself, Sime Darby Plantation Bhd and Sime Darby Property Bhd.

Sime Darby during the demerger was seen almost as an afterthought - a by-product of two other more attractive siblings in the plantation and property sectors.

There were investors who saw the regional business exposure attractive enough to warrant ownership of the stock, and a bumper dividend then in the demerger exercise was the carrot for buying Sime Darby’s stock.

But now, it is Sime Darby’s stock that has held up better than its siblings and its regional exposure is seen as a difference from the many domestic-oriented big-cap stocks on Bursa Malaysia.

In comparison, since the demerger in November 2017, shares in Sime Darby have risen more than 30% to RM2.29 apiece, while Sime Darby Plantation has fallen 0.25% to RM4.81 and Sime Darby Property has plunged almost 30% to 79.5 sen a share.

Sticking to what it knows

Valuable paintings are not the only thing that is hidden within the walls of Sime Darby. The 100-year-old company has a long list of assets and businesses that it is benefiting from, given the expansion that has occurred in the territories it operates in.

From China to Australia, the sale of tractors and cars has bumped up its financial performance in recent times, although there has been some digestion effects of the lingering assets of its demerger exercise.

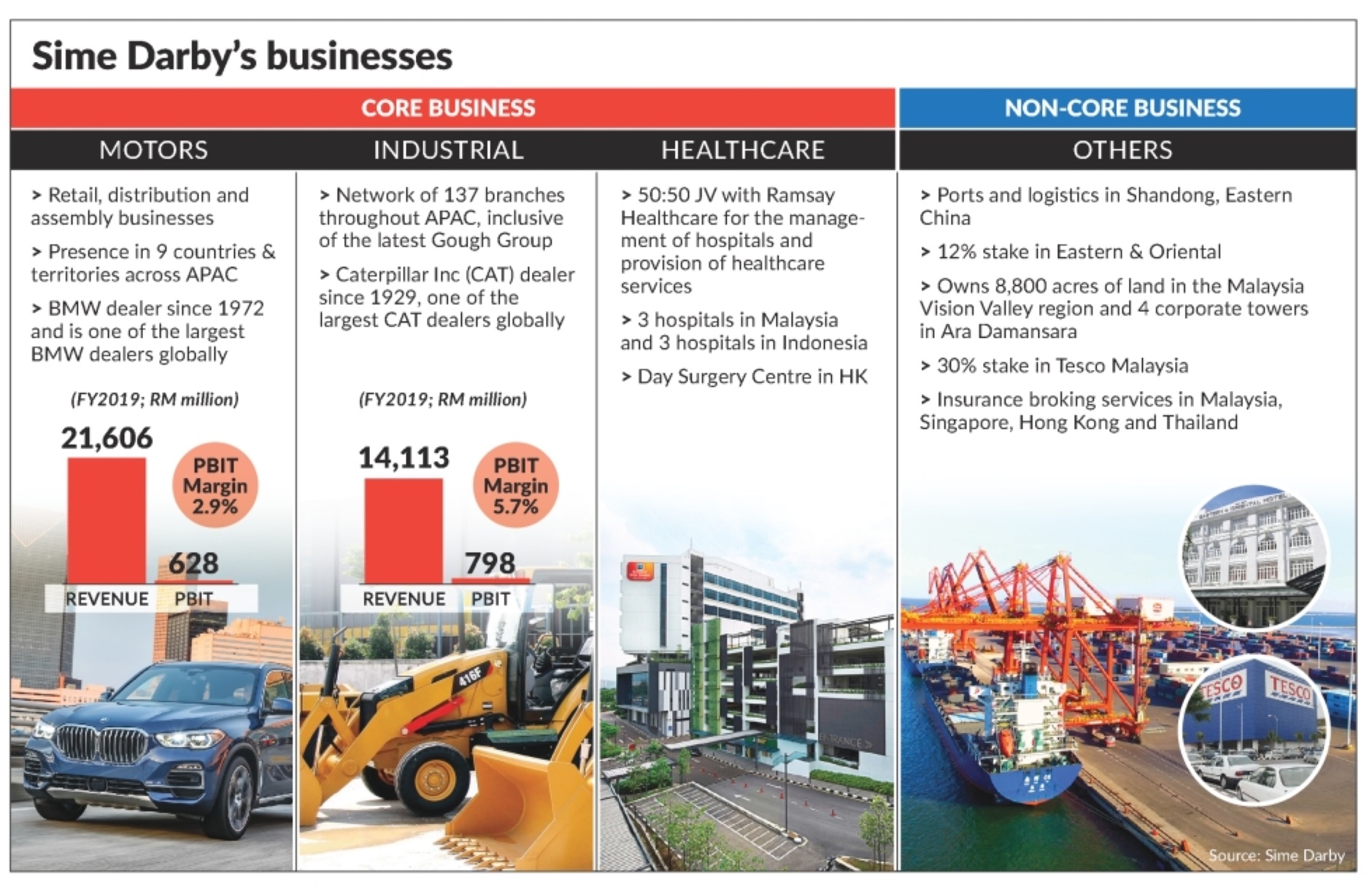

Sime Darby group chief executive officer Datuk Jeffri Salim Davidson tells StarBizWeek at his office in Ara Damansara that moving forward, the Sime Darby group would be focusing on three main businesses – the trading of industrial equipment, luxury car distributorship including BMW, and healthcare.

“We have a solid order book for mining equipment coming out of financial year 2019 (FY19) into FY20,” he says.

“Because of the downturn, there has been under-investment across mining over the last several years. The first wave of recovery has seen increased investment in repair and maintenance for machinery and equipment.

“With the second wave, we expect to see the replacement of fleets, and subsequently for the third wave, investment in new mines,” Jeffri explains.

The performance of the mining sector in Australia, construction activity in China and consumer spending on luxury cars are important to Sime Darby as is the economic growth in those countries.

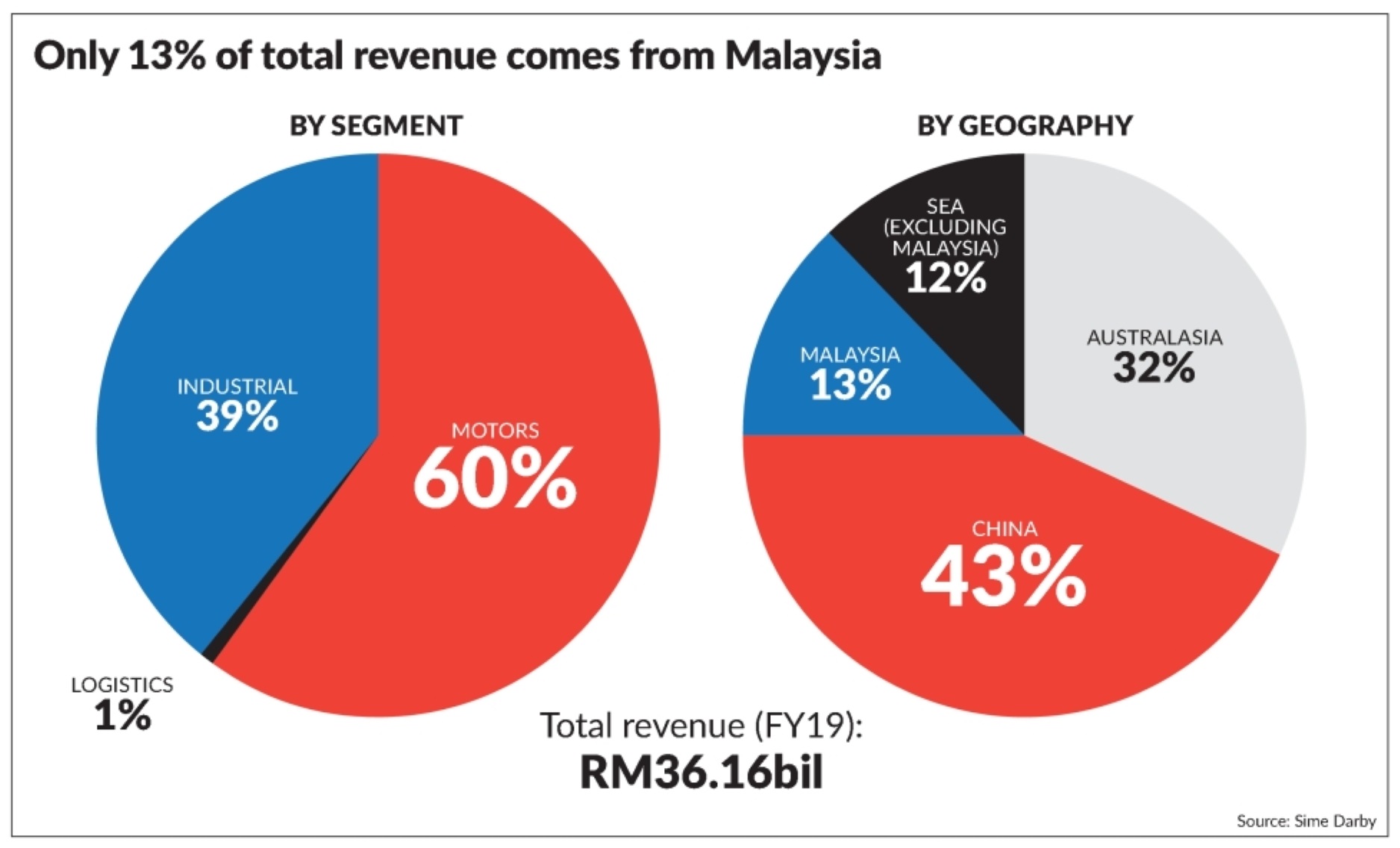

Only 15% of Sime Darby’s earnings is generated from Malaysia, while 85% comes from its overseas operations. This makes Sime Darby a multinational company listed on Bursa Malaysia, with a market capitalisation of RM15bil.

The group is one of the top-five largest Caterpillar and BMW dealers globally.

The mining industry in Australia, Jeffri says, is the main factor that has been driving the company’s earnings.

He says the mining industry is a cyclical business and was on a downturn back in 2013. “Coal prices have recovered since then and the mining sector has seen an uptick.”

When asked if the motoring segment is going to be affected by the trade war between the US and China, Jeffri expects that the impact would be limited to the company.

“But for the luxury car segment, while margins are slightly impacted, volumes are still strong,” he says.

Towards this end, he says total unit sales in China have increased by 22.3% year-on-year in FY19, albeit lower margins.

Given the performance of the luxury segment of auto sales, it comes as no surprise that Sime Darby will be concentrating on the luxury car business.

“While there is a general slowdown in volume for the mass market, the luxury and super luxury markets (in China) are still strong and we are winning market share in those segments.

“While we are insulated in certain ways, we note that trade tensions are negative to the global economy and we are monitoring the potential indirect impact on our business closely,” he says.

While the Sime Darby Group has done quite well last year in growing its earnings in comparison to its sister companies, its margins remain a concern.

For FY19 ended June 30, Sime Darby posted a 53.4% jump in net profit to RM948mil from RM618mil a year ago. Revenue for the period rose 6.3% to RM36.16bil compared to RM33.83bil previously.

On a back-of-the-envelope calculation, Sime Darby’s profit margin for FY19 ended June 30 was 2.6%.

Jeffri agrees that profit margins in the trading business will always be on the thin side, but the company is working to improve it by expanding its healthcare arm and the group’s digitalisation efforts.

Towards this end, he says its industrial segment has been embarking on the digitalisation journey since five years ago that includes developing its own proprietary system and data-sharing platform to streamline work processes.

“Today we have various apps running that improve workflow for our employees. For example, when a machine needs to be repaired, the technician has all the available information on the machine at the tip of his fingers through our app, even before he looks at the physical machine.

“This will ensure that the time the technician spends on the machine is productive and helps with faster turnaround for the customer,” Jeffri says.

Growing the business

At the Sime Darby industrial level, he points out that the digital initiatives have contributed 8% to the division.A couple of months ago, Sime Darby was in a neck-and-neck battle with the Hong Leong Group to buy Columbia Asia hospitals.

Hong Leong together with private-equity firm TPG won the bid in a deal worth US$1.2bil (RM5bil).

The deal though would have significantly boosted Sime Darby’s presence in the healthcare sector, as Columbia Asia owns 17 hospitals in South-East Asia.

“We recently bid for Columbia Asia, but ultimately it all boils down to valuation,” Jeffri says when asked what happened to the deal.

He is not perturbed by losing the bid for Columbia Asia as Sime Darby aims to, over the next five years, double the number of beds from its current 1,577 beds both organically and through mergers and acquisitions.

“Greenfields would take longer to turn around, and hence, we are looking at this in addition to expanding where we can and making better use of our assets,” he says.

At the moment, Sime Darby owns three hospitals in Malaysia and three in Indonesia with its 50:50 joint venture partner, Australia-based Ramsay Healthcare.

The group recently opened a facility in Hong Kong in the form of a day-surgery centre.

In terms of earnings, the healthcare arm contributed about 3% or RM49mil in profit before taxes and interest in FY19.

Aside from growing its healthcare business, Sime Darby is also working on growing its industrial and motoring businesses.

It is noteworthy that its industrial division is underpinned by its Caterpillar dealership in Australia and China, while its motor arm is underpinned by its BMW dealership, especially in China.

In the last couple of months, the group has made a major acquisition involving close to RM1bil for businesses in both the industrial and motoring divisions.

In July, Sime Darby acquired New Zealand’s Gough Group Ltd for NZ$211mil (RM572mil), its largest deal since the group’s restructuring exercise in 2017.

The Gough Group has the Caterpillar dealership in New Zealand and interests in the transport and materials handling business in New Zealand and Australia.

This was followed by a RM321mil acquisition of the assets and properties of three luxury car dealerships – representing the BMW, MINI, Volkswagen, Jaguar and Land Rover marques located in Sydney, Australia.

‘The acquisitions of Gough Group and the three-car dealerships in Sydney are part of our expansion efforts to strengthen our leadership position in the region for our core industrial and motors businesses,” Jeffri says.

The deals are a coup for Sime Darby as it’s rare for a Caterpillar franchise to be up for sale. The price for the motor distributorship business in Australia was lifted by a large piece of prime land where one of the showrooms is located.

Analysts are mainly positive on the Gough Group acquisition as they expect it to drive Sime Darby’s earnings growth, moving forward.

CIMB Research targets the acquisition to add 2%-3% to Sime Darby’s annual profits.

The research house expects that after-sales services would boost the group’s margin expansion in the future.“Margin expansion from the industrial and motor divisions and unlocking its land bank assets are potential re-rating catalysts,” it says in a report.

CIMB has upgraded its recommendation on Sime Darby to “add” from “hold”.

A Bloomberg poll shows that nine analysts have a “buy” call on Sime Darby, and six have “hold” recommendations.

Divestment

We have made it very clear; our focus is on our core trading businesses, which are industrial and motor, as well as growing the healthcare business. We will be very disciplined in maintaining this strategy.

Dato' Jeffri Salim Davidson

The demerger exercise left Sime Darby streamlined to concentrate on the operating areas of the group. While Sime Plantation and Sime Property are left to conduct businesses going by the names of those companies, Sime Darby was left with a hodgepodge of non-core businesses.

Jeffri says the group will focus on the industrial, motoring and healthcare sectors, but it has other businesses that it is willing to sell.

For instance, the group has four ports in Shandong, China, a 30% stake in hypermarket chain Tesco Malaysia, a 12% equity interest in property developer EASTERN & ORIENTAL BHD and insurance broking services in Malaysia, Singapore, Thailand and Hong Kong.

The lucrative non-core asset is the 8,800 acres in Labu, Negri Sembilan that was earlier earmarked for the Vision Valley project.

The rest of the business, he says, will be divested in phases to finance the company’s next phase of growth.

“We are in no hurry and continue to be on the lookout for the right time and opportunity to divest, as there is no immediate urgency to raise cash, given our low gearing levels,” he says.

Notably, in 2015, the group almost floated its motoring division, but that was shelved due to market conditions. It was reported that the listing of Sime Darby’s motoring arm could fetch a valuation of between RM1.5bil and RM3bil.

“There are no plans to spin off our core businesses at this juncture. Together, they make a more substantial offering to shareholders,” Jeffri says.

“We have made it very clear; our focus is on our core trading businesses, which are industrial and motor, as well as growing the healthcare business.

“We will be very disciplined in maintaining this strategy,” he adds.